The government of Bangladesh distributes VAT (Value Added Tax) regulations annually to ensure transparency and compliance across all sectors. For the fiscal year 2025-26, there have been some updates and clarifications regarding VAT rates and deductions for various sectors. This article provides a detailed breakdown of VAT rates and their applicability, ensuring you have all the information to comply with government guidelines.

Key Highlights of VAT 2025-26

- Government Organization VAT Deduction: Government, semi-government, autonomous bodies, NGOs, banks, insurance companies, financial institutions and educational institutions are required to deduct VAT at source.

- Exceptions to VAT Deduction: Certain utilities such as fuel, electricity, and water are exempted from VAT deduction.

- Standard Rate: For sectors not explicitly listed, the default VAT rate is 15%.

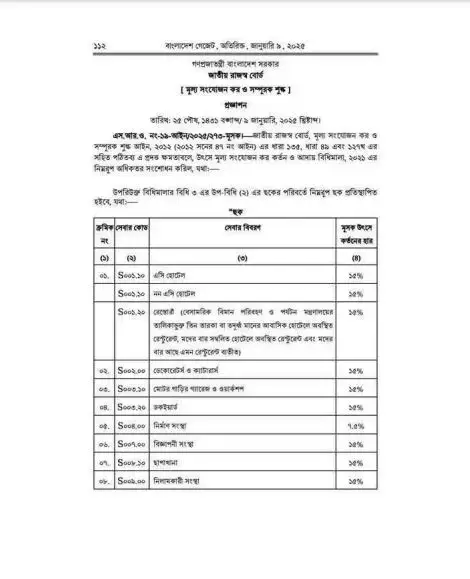

Sector-Wise VAT Rates for 2025-26

| Sector | VAT Rate |

|---|---|

| Catering/Food Purchase (AC) | 15% |

| Catering/Food Purchase (Non-AC) | 5% |

| Motor Garage & Workshop | 15% |

| Construction Firms | 7.5% |

| Furniture Showrooms | 7.5% |

| Fuel (CNG/Octane/Diesel) | 5% |

| Mechanical Laundry Services | 15% |

| Dockyard | 15% |

| Auctioneer Services | 15% |

| Auctioned Product Buyers | 7.5% |

| IT-Dependent Services | 5% |

| Printing Press | 10% |

| Indenting Agency | 15% |

| Internet Providers | 5% |

| Repairing & Servicing | 10% |

| AC or Heated Launch Services | 5% |

| Board Meeting Suppliers | 10% |

| Building, Floor & Yard Maintenance | 10% |

| Purchase or Supply Vendors | 10% |

| Miscellaneous Services | 15% |

Updates on Tobacco Tax

In the 2025-26 fiscal budget, supplementary duties on cigarettes and bidis have increased. As a result, the prices of these items are expected to rise. The supplementary duty proposed includes a 57% duty on low-cost 10-stick cigarette packs priced at Tk 40 or higher. Smokeless tobacco products are also set for a price hike.

Consequences of Not Depositing VAT on Time

- Penalty for Non-Deduction: If VAT deduction is neglected, the undeducted amount will be collected with a biannual 2% interest.

- Penalty for Non-Deposit: Failure to deposit deducted VAT into the government treasury on time will result in a personal fine of Tk 25,000 as per Section 85 (Sub-section 1k) of the VAT Law.

- Shared Responsibility: Both the supplier and recipient of goods or services are equally liable for failure to deposit VAT on time.

Simplified VAT Deduction Process

If you need to deduct and deposit VAT, follow these simple steps:

- Identify the applicable VAT rate for the goods or services.

- Deduct the appropriate amount at the source.

- Deposit the deducted VAT into the government treasury using the prescribed challan.

Why Timely VAT Payment Matters

Timely payment of VAT ensures compliance and avoids penalties. It also helps the government maintain its revenue flow for public welfare projects. Non-compliance not only invites penalties but can also lead to legal complications.

Final Words

Understanding and adhering to the updated VAT regulations is crucial for both individuals and organizations. This guide provides a clear roadmap for compliance with VAT rules in Bangladesh for the fiscal year 2025-26.

Stay informed, comply with the rules, and ensure timely VAT deductions and deposits to avoid penalties. If you have further questions, consult the official VAT rules or seek assistance from a tax professional.